6

-

50

100

150

200

250

Metals price index, Feb 2020 – Feb 2023

-

50

100

150

200

250

300

Commodity markets have seen unprecedented volatility with significant supply/demand

imbalances in critical materials

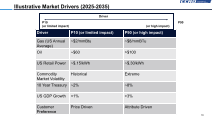

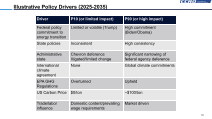

Context Setting Technology Policy &Regulatory Geopolitics Climate Market

Brent crude oil price index, Jan 2019 – Jan 2025

Source(s): S&P Reuters Financial Times

Key

Tin Aluminium Copper Cobalt Nickel

1 2

4

5

Brent

crude

oil

Other

metals

Recent

changes

⦁ Copper – vacillated on economic news out of China and DeepSeek

AI’s efficiency claims, creating uncertainty around outlook of

datacentre growth

⦁ US metal prices recently soar due to tariff announcements

⦁ Sharp decline due to Covid which led to demand collapse,

exacerbated by increased oil production due to price war in

OPEC+

Oil prices surged in 2022 due to post-pandemic recovery of

demand, supply constraints from OPEC+ cuts, Russia-Ukraine war

which led to supply disruptions and sanctions

Prices have stayed relatively high due to OPEC+ continuing to limit

production and reduced investment in new drilling constraining

supply

1

2⦁

Pandemic related challenges in 2021 led to shortage of critical

materials, and significant delays driving commodity price volatility

⦁ Metal prices fell due to a global economic slowdown, rising interest

rates, supply recovery, lower EV battery metal demand

– Nickel saw more volatility due to initial optimism over China’s

post Covid reopening &temporary global supply constraints

towards the end of 2022, but in 2023 oversupply of Nickel and

waning EV demand drove prices down again

4⦁

5

$18/barrel

$123/barrel

$79/barrel

3⦁

3

-

50

100

150

200

250

Metals price index, Feb 2020 – Feb 2023

-

50

100

150

200

250

300

Commodity markets have seen unprecedented volatility with significant supply/demand

imbalances in critical materials

Context Setting Technology Policy &Regulatory Geopolitics Climate Market

Brent crude oil price index, Jan 2019 – Jan 2025

Source(s): S&P Reuters Financial Times

Key

Tin Aluminium Copper Cobalt Nickel

1 2

4

5

Brent

crude

oil

Other

metals

Recent

changes

⦁ Copper – vacillated on economic news out of China and DeepSeek

AI’s efficiency claims, creating uncertainty around outlook of

datacentre growth

⦁ US metal prices recently soar due to tariff announcements

⦁ Sharp decline due to Covid which led to demand collapse,

exacerbated by increased oil production due to price war in

OPEC+

Oil prices surged in 2022 due to post-pandemic recovery of

demand, supply constraints from OPEC+ cuts, Russia-Ukraine war

which led to supply disruptions and sanctions

Prices have stayed relatively high due to OPEC+ continuing to limit

production and reduced investment in new drilling constraining

supply

1

2⦁

Pandemic related challenges in 2021 led to shortage of critical

materials, and significant delays driving commodity price volatility

⦁ Metal prices fell due to a global economic slowdown, rising interest

rates, supply recovery, lower EV battery metal demand

– Nickel saw more volatility due to initial optimism over China’s

post Covid reopening &temporary global supply constraints

towards the end of 2022, but in 2023 oversupply of Nickel and

waning EV demand drove prices down again

4⦁

5

$18/barrel

$123/barrel

$79/barrel

3⦁

3