14

0%

5%

10%

15%

20%

25%

30%

Jan-18 Jul-18 Jan-19 Sep-19 Mar-20 Feb-21 Apr-22 Apr-23

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Jan-18 Jul-18 Jan-19 Sep-19 Mar-20 Feb-21 Apr-22 Apr-23

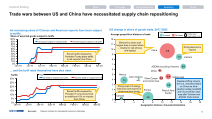

Trade wars between US and China have necessitated supply chain repositioning

Context Setting

An increasing share of Chinese and American exports have been subject

to tariffs…

Technology Policy &Regulatory Geopolitics Climate Market

Source(s): Peterson Institute for International Economics, McKinsey

Share of exported goods subject to tariffs

Tariffs

… and the tariff rates themselves have also risen

Key

US exports subject to Chinese tariffs Chinese exports subject to US tariffs

Key

US tariffs on imports from China Chinese tariffs on imports from US

0.3

1.4 0.1

2.9

-0.4

-0.2

-0.8

0.8

0.8

1.0

-5.8

0

1

2

3

4

5

6

7

8

9

10

11

12

0 2 4 6 8 10 12 14 16 18

China

US change in share of goods trade, 2017-2023

Average geopolitical distance of trade

Vietnam

ASEAN (excluding Vietnam)

Africa

Middle East Other Europe

and Central Asia

Latin America

Mexico

Canada

Europe Rest of Asia-

Pacific

Geographic distance, thousand kilometers

Key

Increase Decrease

Circle size =

trade share %Δ

Rising export of energy

resources and imports of

pharmaceutical goods

Rising electronics

imports

Electronics sector saw

largest drop in import share

– notably for cell phones

and laptops

Despite shifting imports,

the U.S. remained reliant

on China via third-

country routing, but 2023

anti-circumvention laws

may alter Vietnam and

ASEAN trade shares

Recent tariffs imposed by

President Trump announced

an additional 10% on imports

from China

Recent tariffs imposed by

President Trump place tariffs

on all imports from China

0%

5%

10%

15%

20%

25%

30%

Jan-18 Jul-18 Jan-19 Sep-19 Mar-20 Feb-21 Apr-22 Apr-23

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Jan-18 Jul-18 Jan-19 Sep-19 Mar-20 Feb-21 Apr-22 Apr-23

Trade wars between US and China have necessitated supply chain repositioning

Context Setting

An increasing share of Chinese and American exports have been subject

to tariffs…

Technology Policy &Regulatory Geopolitics Climate Market

Source(s): Peterson Institute for International Economics, McKinsey

Share of exported goods subject to tariffs

Tariffs

… and the tariff rates themselves have also risen

Key

US exports subject to Chinese tariffs Chinese exports subject to US tariffs

Key

US tariffs on imports from China Chinese tariffs on imports from US

0.3

1.4 0.1

2.9

-0.4

-0.2

-0.8

0.8

0.8

1.0

-5.8

0

1

2

3

4

5

6

7

8

9

10

11

12

0 2 4 6 8 10 12 14 16 18

China

US change in share of goods trade, 2017-2023

Average geopolitical distance of trade

Vietnam

ASEAN (excluding Vietnam)

Africa

Middle East Other Europe

and Central Asia

Latin America

Mexico

Canada

Europe Rest of Asia-

Pacific

Geographic distance, thousand kilometers

Key

Increase Decrease

Circle size =

trade share %Δ

Rising export of energy

resources and imports of

pharmaceutical goods

Rising electronics

imports

Electronics sector saw

largest drop in import share

– notably for cell phones

and laptops

Despite shifting imports,

the U.S. remained reliant

on China via third-

country routing, but 2023

anti-circumvention laws

may alter Vietnam and

ASEAN trade shares

Recent tariffs imposed by

President Trump announced

an additional 10% on imports

from China

Recent tariffs imposed by

President Trump place tariffs

on all imports from China